If you think this week’s relief rally (after Trump’s 90-day pause on tariffs) is the end of the trade war—it’s not. And it’s not the end of stock market pain either.

As usual, much of the market “news” is focused on the short-term, and investors are ANGRY with Trump’s “Liberation Day” whereby markets are immediately down big. However, what are the actual benefits, risks and investment opportunities created by the newly announced tariffs? Let’s dig in.

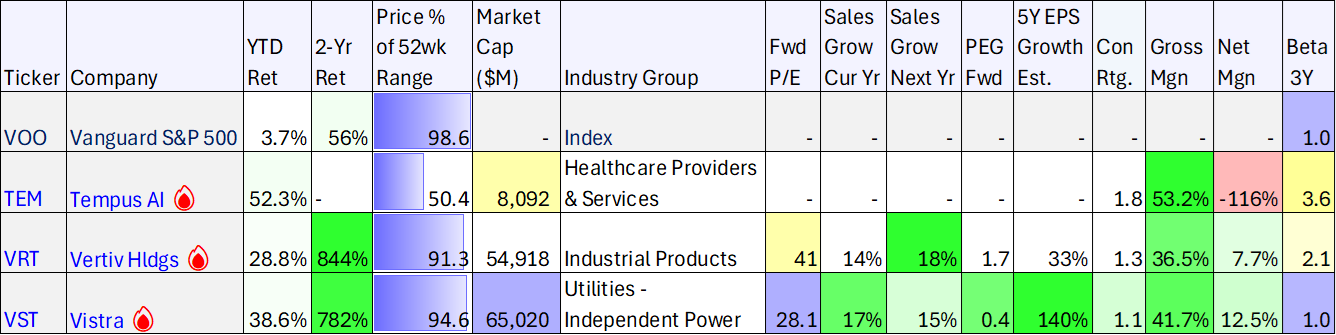

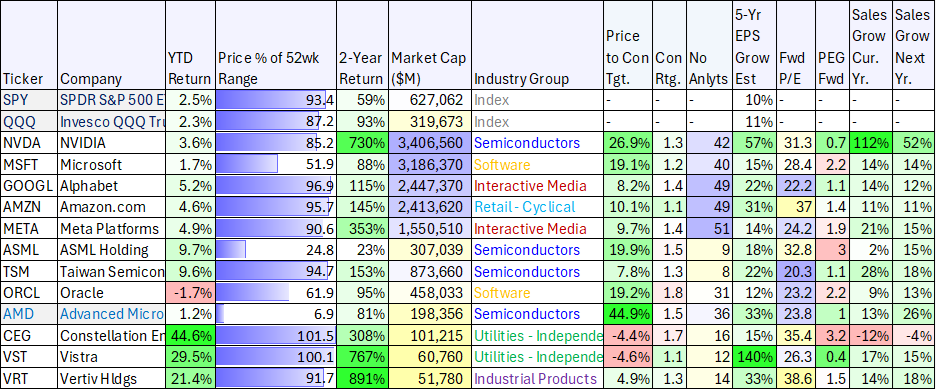

As you can see in the following table, many of the top AI-related stocks are down big in recent months.

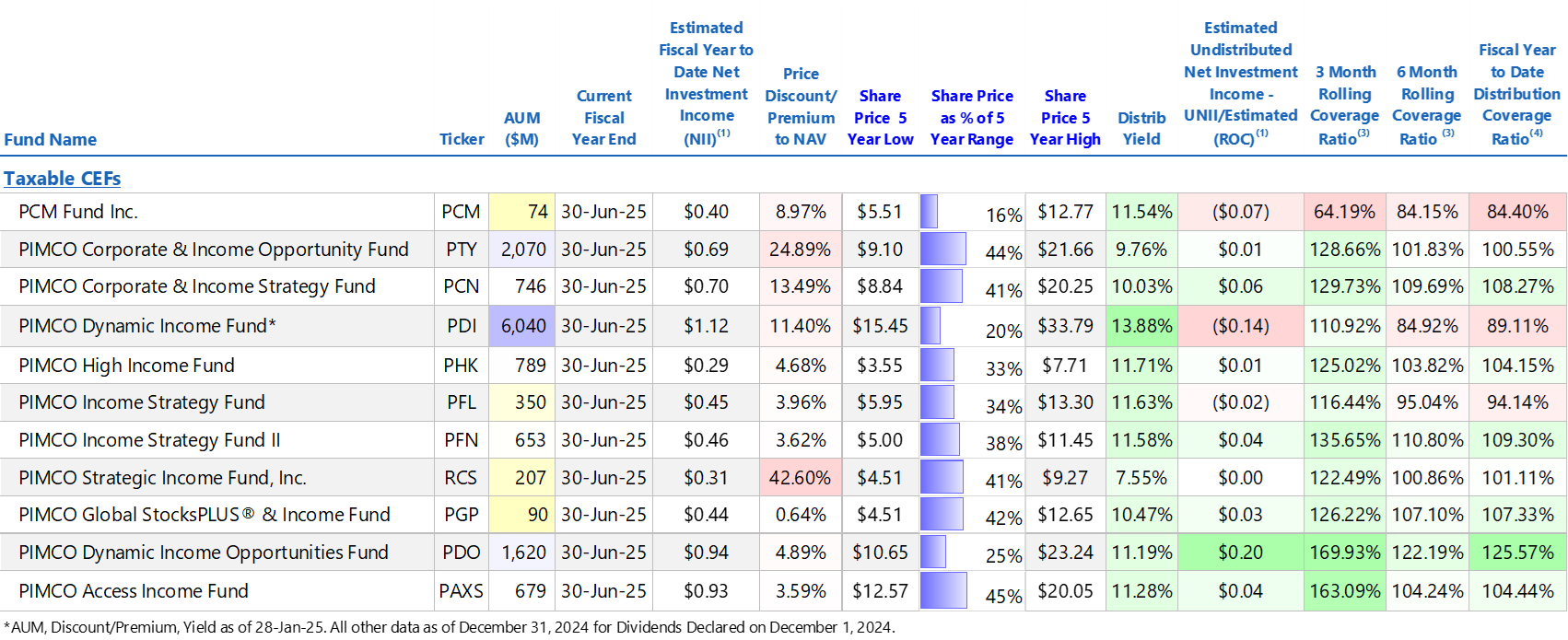

There are lots of yields over 10% to choose from (such as those in the table below), and some of them are actually worth considering (especially 2 of the top 3 specifically highlighted in this report). But how safe is it really to own such massive income-producing investments? (especially at this point in the market cycle). We’ll build up to that answer (in the conclusion) by reviewing three specific big yielders (one REIT, one BDC and one CEF). Enjoy!

A lot of investors think Private Equity (“PE”) is some magical, uncorrelated, rich-person recipe for wealth. But in reality, it’s based on the same economy as public equities (i.e. stocks), the low correlation is largely a mirage (PE just provides less frequent/delayed valuations), the fees and expenses are higher, and the operational and opportunity costs (of inconvenient capital calls and lockup periods) are a royal pain.

As you can see in the chart, this year has been a tale of two markets—with the 10 largest US stocks (by market cap) decisively underperforming the other “490” S&P 500 stocks (even though both groups have somewhat similar combined market caps—i.e. MAG 10 is more than 35% of the S&P 500—even after the large decline). There is a lesson in this, and it’s probably not what you think…

It’s going to get worse. That’s how many people feel about the current stock market selloff, and based on history—they could be right. But before going down the pointless rabbit hole of attempting to perfectly time the bottom, there is another way to invest. It’s called income investing. And in this report, I share 5 big-yield investment strategies (plus a handful of individual top ideas) that some investors may want to consider as a critical component of their long-term investment strategy.

One secret to great investing is to ignore the day-to-day noise; but with Trump tariffs now wrecking stocks, you may NEVER retire.

That’s how a lot of investors feel right now with the Nasdaq100 (QQQ) down 13% in 3 weeks (that’s more than the entire stock market typically gains in a year!).

So now what?

Panic sell all your stocks? Cancel retirement and work forever?…

Yes, Artificial Intelligence (“AI”) has been hot. And yes, the market just pulled back hard. So, is this just the latest bubble bursting, or is it an opportunity to buy things on sale? Unless you have a working crystal ball, there is absolutely a right way, and a wrong way, to invest in AI.

As you can see in the 10-day return column, Artificial Intelligence (“AI”) stocks have been particularly volatile. Much of this volatility is fear-driven and has thereby created select attractive opportunities, as the AI megatrend is still fully intact (i.e. it’s in its early innings). In this report, I share 4 top AI growth stocks for you to consider, especially following the recent fear-driven selloff (i.e. “buy lower” opportunities).

AI has been hot. From semiconductors, to software and social media, and especially datacenter infrastructure and energy demand, we have seen stock prices soaring. However, one name that stands out for both massive AI growth and an extremely low valuation, is Super Micro Computer. Obviously, SMCI has warts on it (e.g. their auditor resigned, they’ve been dropped from the Nasdaq 100 (QQQ) and volatility has been extraordinary). However, SMCI has remained a critical part of the AI megatrend, and 2025 is on pace to be a banner year (thanks, in large part, to the accelerating shift from Nvidia Hopper to Blackwell GPUs). After reviewing the AI landscape and the SMCI particulars, I conclude with my strong opinion on investing.

Super Micro Computer (SMCI), a maker of server and storage solutions, may be about to go on an epic share price rally (courtesy of AI, its new auditor, and its relationship with Nvidia, in particular).

Earning 2% on your savings account isn’t much better than hiding cash under your mattress considering inflation just came in hot, at 3%, thereby silently killing the buying power of your money and your wealth. Here are 4 things you can do about it.

There are a lot of people that demand “big yield” from their investment portfolios. And they demand it, pursue it and define it, in widely different ways. In this report, I review 5 different big-yield portfolio strategies (ranging from 10%+ yields, monthly-pay strategies, and dividends versus distributions) for investors with $2 million in investable assets (or thereabouts), as well as a handful of risks and mistakes to avoid. I conclude with my strong opinion on which strategy is best.

Software stocks have been on fire lately, with names like Palantir, Fortinet and Atlassian posting big post-earnings gains. Here is a look at the most highly-rated software stocks set to report earnings over the next 3-weeks, with the potential for more big post-earnings surprise gains ahead (below), plus a closer look at Palo Alto Networks in particular.

Palantir is a controversial investment because, despite its incredible healthy growth, the valuation is very high (and because the software is used to kill bad guys). Let’s take a brief look at its latest earnings report, current valuation, and powerful business growth trajectory.

Tariffs are nothing new in the US, but they have a long history of being controversial. The following chart shows the average US tariff rate on imports since the 1820’s, followed by an excellent explanation of the 1930 “Hawley-Smoot” tariff, as per Ben Stein… Anyone? Anyone?…

The market has been on uncertain footing over the last week since news that Chinese startup, DeepSeek, has built a better AI solution (than US leaders) on a tiny fraction of the budget. This week, uncertainty will continue with big earnings announcements (from Palantir, Google and Amazon) and of course the huge impacts of new tariffs from the Trump Administration. These news items could set the market’s direction for months and quarters ahead, especially considering an increasing chorus of investors believes the market is ahead of itself as per over-stretched valuation metrics due for a snapback.

One positive theme that emerged from Meta’s quarterly earning call this week is that CEO Mark Zuckerberg seems largely unfazed by the threat of new Artificial Intelligence competitor, DeepSeek. Instead, the guy is aggressively focused on growth and opportunities ahead. Here are five (5) Mark Zuckerberg quotes from the call that stood out as impressive and encouraging for Meta’s continued high-growth trajectory.

If you like your investments to pay big monthly income, PIMCO is the bond fund industry leader, with lots of double-digit yields to choose from. This report compares data on 10 taxable PIMCO closed-end funds (CEFs), and explains why the Dynamic Income Opportunities Fund (PDO) is particularly attractive right now.

So Artificial Intelligence (AI) darling of the world, Nvidia (NVDA), was down 17% on Monday following news that China startup, DeepSeek, had created an AI application “superior” to US leaders (e.g. OpenAI), and DeepSeek had accomplished this on only a tiny fraction of the budget. Specifically, DeepSeek doesn’t need all those expensive Nvidia chips that the rest of the world has been spending hundreds of billions of dollars on. Here are 5 lessons for Nvidia investors to keep in mind.

Artificial Intelligence (AI) is hot. And in this quick note, I share data on 3 of the absolute hottest AI stocks right now. Each one is very different than the others.

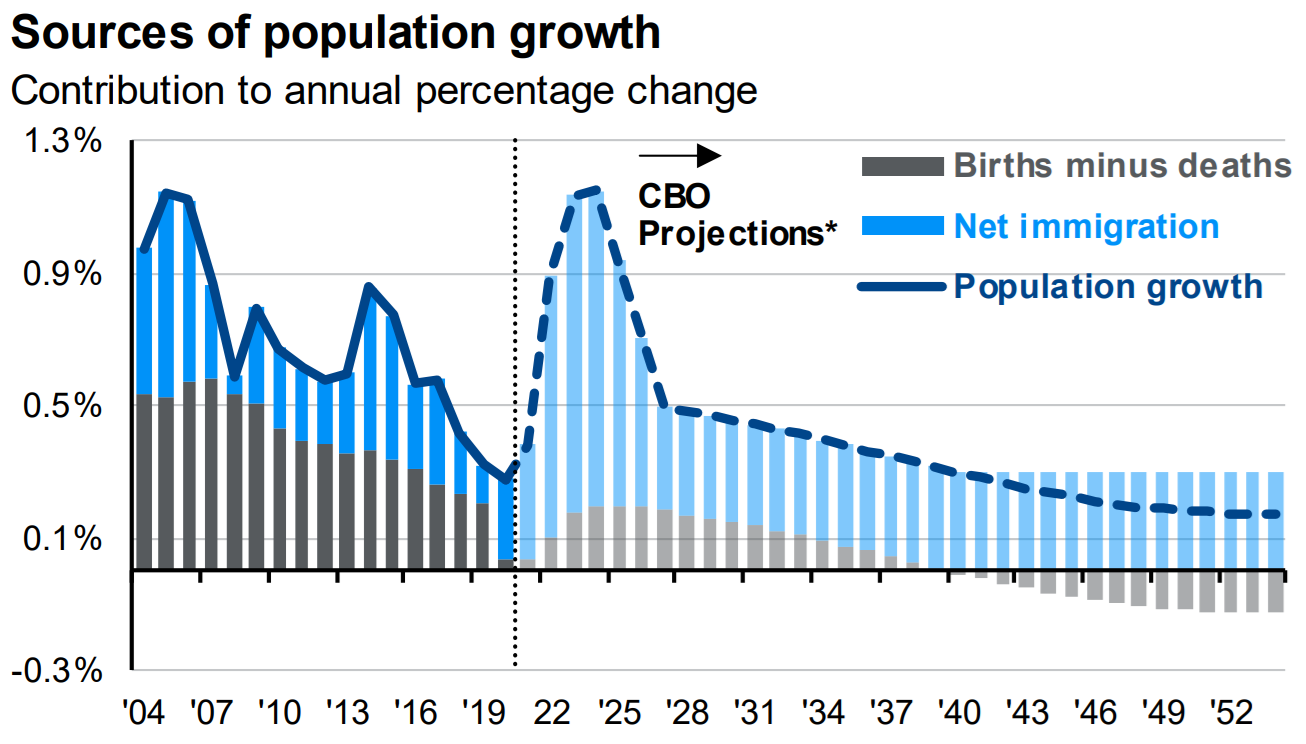

Just how concerning is the slowing US population growth for long-term US stock market investors? Let’s take a look…

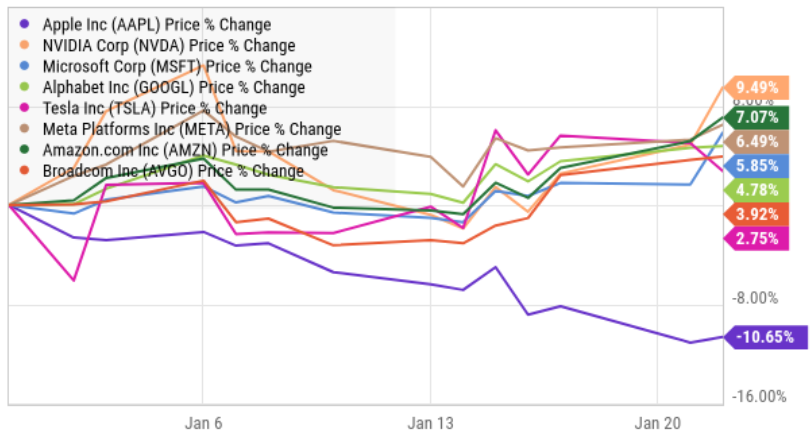

Apple (AAPL) shares have been weak this year as compared to other mega-cap names (as you can see in the chart). And with iPhone market share falling in China, some investors are wondering if it’s time to dump your shares.

Here are five (5) key points to consider, followed by my personal opinion on selling versus buying and/or holding the shares.

Advanced Micro Devices’ (AMD) revenue has been growing rapidly. This is because of its datacenter tie in with Artificial Intelligence (“AI”) and the great cloud migration and digital revolution. However, the shares have been falling, sitting near a 52-week low. In this report, I review the business, the AI megatrend, AMD’s valuation and the big risk factors for investors. I conclude with my strong opinion on investing.

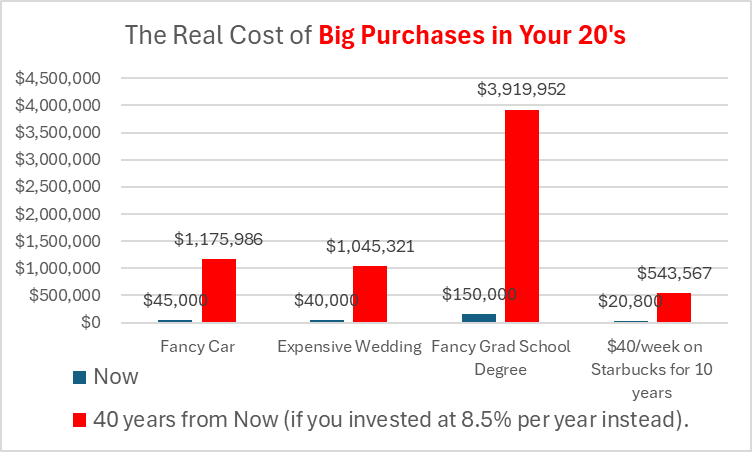

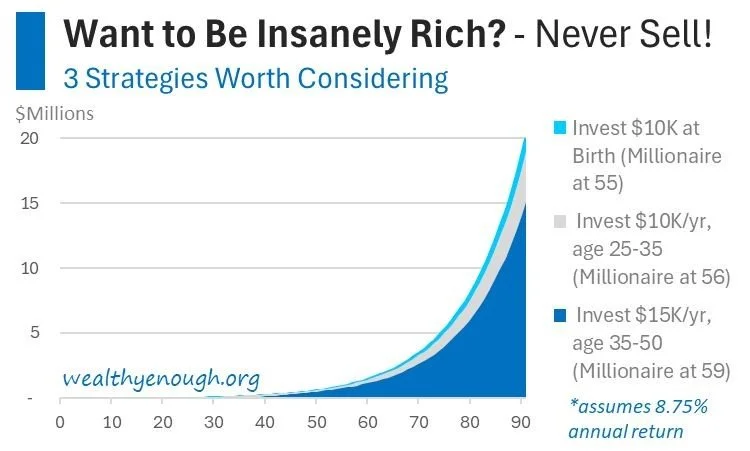

Let's be honest. The best path to multi-millionaire status in the USA is to follow these 3 steps:

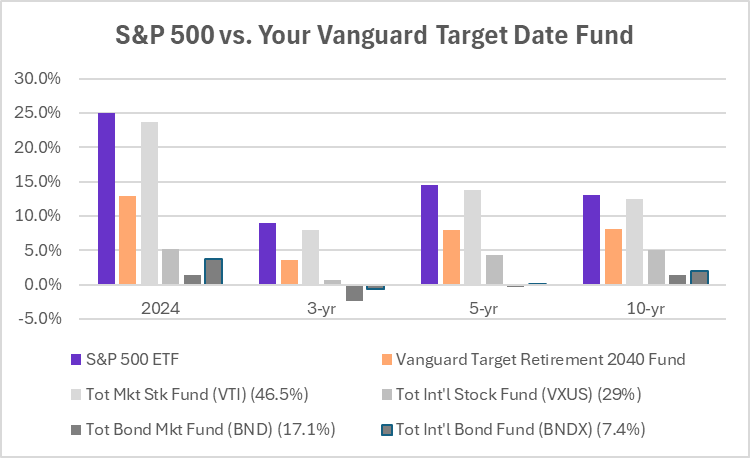

Another year (2024), and your Vanguard “Balanced” Target Retirement Fund just got smoked (by the S&P 500), again!

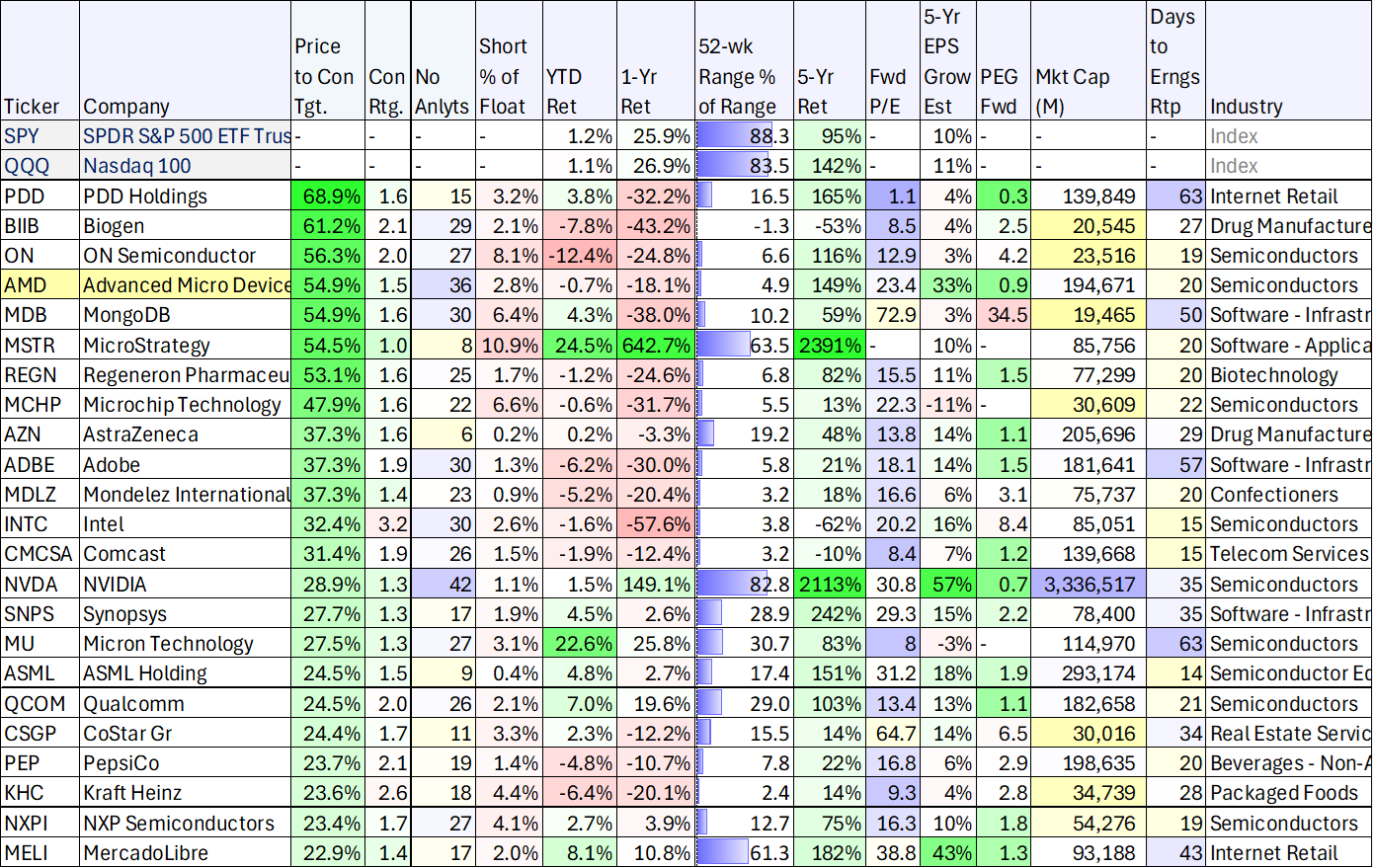

With earning season about to pick up in full force, and whether or not you are a “momentum” or “contrarian” investor, here is a look at how Wall Street analysts currently rank all 100 Nasdaq 100 stocks (QQQ) (including the percentage by which each one is “over” or “under” valued.

The one (1) thing you should do if you have a bad boss and/or work in a toxic corporate culture: Save and invest part of your paycheck so you’re not stuck in that environment forever.